Business bosses warn new tax could hit jobs

A new health and social care tax to pay for reforms and the NHS in England has come under fire from business groups.

The British Chambers of Commerce (BCC) said it would “be a drag anchor on jobs growth” as firms emerge from the pandemic and furlough winds down.

Manufacturing trade group Make UK’s boss also described its introduction as “ill-timed as well as illogical”.

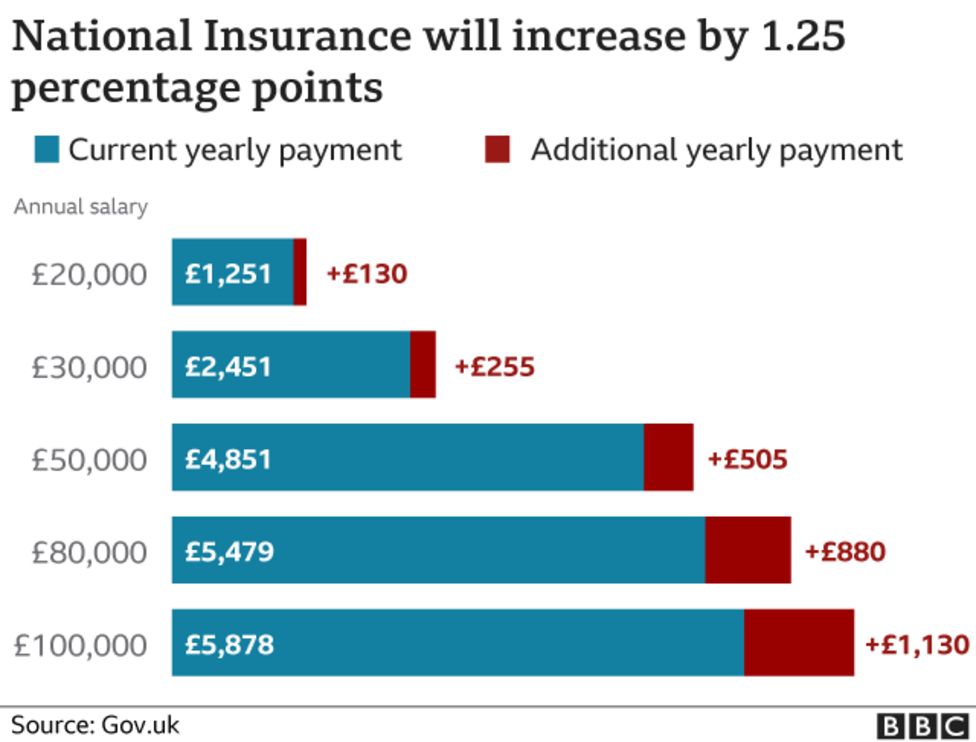

The tax will begin as a 1.25% rise in National Insurance for employees and employers from April 2022.

It will then become a separate tax on earned income from 2023 – appearing on an employee’s payslip.

The prime minister has insisted the new levy was “the reasonable and the fair approach”, despite the fact it breaks a key manifesto commitment.

Downing Street said that a typical basic rate taxpayer earning £24,100 would pay £180 a year, while a higher rate taxpayer on £67,100 would pay £715 as a result of the new tax.

Currently, National Insurance is paid by both businesses and staff.

Suren Thiru, head of economics at the BCC, said that it was opposed to the increase.

“Firms have been hammered by 18 months of covid related restrictions and have built up huge debt burdens.

“This rise will impact the wider economic recovery by landing significant costs on firms when they are already facing a raft of new cost pressures and dampen the entrepreneurial spirit needed to drive the recovery,” he said.

Lord Karan Bilimoria, president of the CBI, said: “After all that business has gone through during the pandemic and the fantastic government support that followed, now is not the time for tax increases.

“It’s time to stimulate investment and growth in the economy.”

‘Not the right tax’

Stephen Phipson, chief executive of Make UK, said that while industry recognises the need to increase funding for the NHS and reforms to the care sector, “firms need capital to reset”.

“After witnessing large scale redundancies at the height of the pandemic and the plug being pulled on the furlough scheme, government should be putting in place measures to protect jobs and incentivise recruitment,” he said.

He called on the government to consider other streams of revenue.

Paul Johnson, director of the Institute for Fiscal Studies (IFS), told the BBC’s World at One programme that National Insurance was “not the right” tax to put up to pay for social care reforms.

The economist said: “We always knew we were going to need tax rises during this decade to pay for health and social care.

“This is not the right tax rise – income tax would be better, some other ones would have been better.

He added: “If you had to do something with income tax, National Insurance or VAT, it would have been better if it had been something which impacted all generations similarly, it would be better if it affected people with rental income and so on.”

The new tax will, however, be paid by all working adults, including those over the state pension age, unlike other National Insurance contributions.

Prime Minister Boris Johnson also announced on Tuesday that a tax on income from dividends, which are levied on business owners and investors, will also increase by 1.25% from April 2022.

‘A kick in the teeth’

Kitty Ussher, chief economist at the Institute of Directors, said the plan demonstrated a lack of understanding of the difficulties small business owners face.

She added: “The surprise new tax on dividends will yet again target small company directors.

“Incorporated sole traders and other owner-managers, who relied on dividend income, were the only group of workers that were not supported by government during the pandemic,” she said, referring to those who were not entitled to special funding schemes during the pandemic.

Although designed to spread the pain of future tax increases, Sarah Coles, personal finance analyst at Hargreaves Lansdown, described the move as a “kick in the teeth”.

“Given that so many of them will also have a higher National Insurance bill, it deals them a double blow at a difficult time,” she said.

Source: www.bbc.com