Brussels Edition: Draghi’s Farewell, Climate Talks, Apple Tax

Mario Draghi’s valedictory appearance at the European Parliament today may provide a forum for plaudits and criticism of a man who is seen by some as the savior of the euro; by others as the Italian who got southern Europe hooked on cheap credit. As his final bout of stimulus works its way through the economic plumbing, his successor, Christine Lagarde, may look to a non-euro zone member — Denmark — for what happens when banks start charging a large swathe of their customers for storing money.

What’s Happening

Climate Conclave | World leaders head to New York for a United Nations summit that seeks to galvanize action against climate change. Angela Merkel, whose emissions deal was criticized by both environmentalists and industry lobbyists, will speak at the gathering today. She’ll be joined by many of her counterparts from Europe, where climate has been catapulted to the top of the political agenda amid increasing bouts of drought and wildfires.

Brexit Crunch | Brexit will also travel to New York, with Boris Johnson holding vital meetings with European leaders less than six weeks before the deadline for the U.K. to leave the EU. Talks also continue in Brussels in the wake of the European Commission’s thorough panning of British proposals submitted so far. And in London, the Supreme Court will rule on whether Johnson suspended Parliament illegally as part of his Brexit strategy.

Apple Case | Apple may only need to wait until tomorrow to get early indications about its chances of success in the biggest tax case in recent history. The same panel of judges that will decide on its bid to topple a record 13 billion-euro EU tax order will deliver a ruling on two smaller but related challenges by Starbucks and Fiat Chrysler, potentially offering clues on how its own case could evolve.

Plane Levies | This week could also see movement in a looming U.S.-EU tariff battle over illegal aircraft subsidies. A decision by the WTO allowing the U.S. to slap levies on billions of European exports is entering its final stage and the trade body will soon reveal the amount of EU exports that may be affected. While the EU is seeking to avoid such an escalation, the U.S. seems set on pushing ahead.

In Case You Missed It

Labour Ruptures | It’s not only Johnson struggling to hold his party together over Brexit. The Labour Party’s annual conference this week started with a botched attempt to remove its pro-EU deputy leader, Tom Watson, whose insistence on campaigning for Remain is at odds with opposition leader Jeremy Corbyn’s plan to hold a second referendum only after negotiating a “credible” deal with Brussels. He’d stay neutral while the public decided between his deal or Remain.

Spanish Split | Mas Madrid, an anti-austerity party, opted to contest general elections in November in a move that could further fracture the left-wing vote going into Spain’s fourth national ballot in as many years. Mas Madrid is led by Inigo Errejon, who broke ranks in January with Podemos, the party he helped found. His new movement won 20 seats in Madrid regional elections in May, compared with just seven by Podemos.

Putin’s Embrace | For most of his two decades in power, Vladimir Putin has challenged the assertion that global warming is due almost exclusively to human activity. But now, as the leader of the world’s fourth-largest emitter, he has finally decided to ratify the 2015 Paris Agreement — and the reasons behind this have less to do with the fate of the planet than with geopolitics and gross domestic product.

New Tools | Central banks can’t fix a stalling world economy with their current tools, so some of the biggest names in finance are trying to invent new ones. Proposals so far have one thing in common: They foresee the once all-powerful central bankers taking a more junior role and collaborating with governments, as an emerging consensus says the next downturn may need to be fought with direct and permanent injections of cash and that central banks can’t deliver it alone.

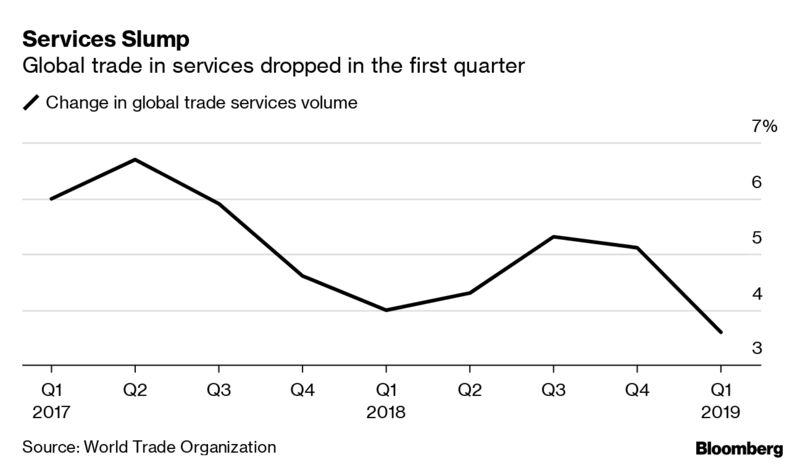

Chart of the Day

Global trade in services slowed during the first quarter of 2019, according to a new World Trade Organization report. The report describes a “broad loss in momentum” among various services sectors like finance, technology, tourism and transportation. The WTO has already slashed its global trade growth projection for 2019 to the lowest level in three years, citing the impact of rising commercial tensions and tariffs.