In Zuck we trust: Facebook to launch own Cryptocurrency

Facebook’s plans to mint its own digital coin next year will test the company’s consumer credibility. After being savaged for months for its cavalier attitude toward users’ privacy, the social network will be asking those same users to trust its new cryptocurrency.

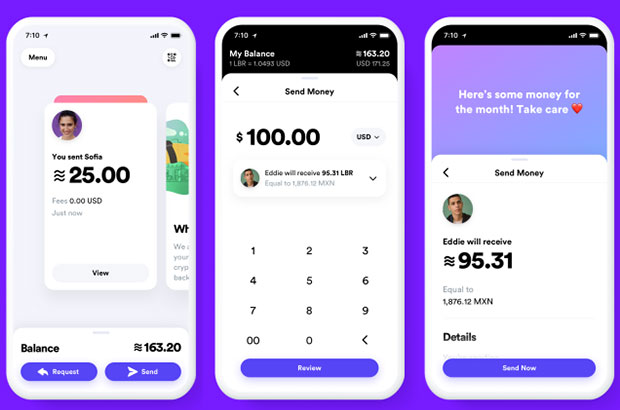

The currency, called “Libra,” will be stashed in a digital wallet, the first product of new Facebook financial services subsidiary Calibra, announced Tuesday. The wallet will be available in Messenger and WhatsApp, as well as in a standalone program.

Calibra will let users send Libra to almost anyone with a smartphone as easily as sending a text message, and with low to no cost, Facebook has pledged. That could give some consumers amnesia about Facebook’s sordid past, at their peril.

“If Facebook has this financial information about me, will they target me in different ways?” asked Josh Crandall, CEO of NetPop Research, a market research and strategy consulting firm in San Francisco.

“That’s something that consumers will have to evaluate on their own because I don’t think they can trust Facebook with the information that they give it today,” he told TechNewsWorld.

Don’t Believe the Hype

Facebook promised to take steps to protect the privacy of Calibra users.

Aside from limited cases, Calibra will not share account information or financial data with Facebook or any third party without customer consent, the company said. This suggests Calibra customers’ account information and financial data will not be used to improve ad targeting on the Facebook family of products.

The limited cases in which data may be shared align with Facebook’s need to keep people safe, comply with the law, and provide basic functionality to the people who use Calibra, the company explained. Calibra will use Facebook data to comply with the law, secure customers’ accounts, mitigate risk and prevent criminal activity.

“No one should ever believe anything that Facebook says, especially after reading Sam Biddle’s article in The Intercept,” said Jeffrey Carr, managing director of Reel Holdings, a cryptocurrency and entertainment company in Jackson, Wyoming.

Biddle’s piece, published last week, is about a class action lawsuit against Facebook over the sharing of user data with Cambridge Analytica, and later with advisers to Donald Trump’s presidential campaign, without user permission.

Only months after Facebook CEO Mark Zuckerberg first outlined his “privacy-focused vision for social networking” in a 3,000-word post on the social network he founded, his lawyers were explaining to a California judge that privacy on Facebook is nonexistent, Biddle pointed out.

“I fear that consumers will believe Facebook instead of being cautious of the marketing hype,” Carr told TechNewsWorld.

“This cryptocurrency should be avoided at all costs,” he said of Libra.

‘An iPhone Moment’

It will be a battle for Facebook to change it’s culture to operate in financial services, Crandall said.

“The world has come to understand that Facebook has not upheld our trust to manage our privacy. It’s eviscerated privacy for its own gains,” he maintained. “The question is, will Facebook’s culture change to support an infrastructure that is trustworthy of our financial information?”

Privacy will be a legitimate concern for Calibra, noted Steven Eliscu, executive vice president of corporate development at DMG Blockchain, a blockchain and cryptocurrency company based in Vancouver, Canada.

“Just as Alipay and WeChat Pay are vehicles to potentially allow the Chinese government to monitor the transactions of its citizens, in a similar way Facebook could allow transaction data to be used in a way that invades user privacy,” he told TechNewsWorld.

“Given ongoing news about Facebook in this regard, we expect privacy concerns to remain at the forefront,” Eliscu said.

Nevertheless, Libra is a significant development for digital money, he added.

“While the Facebook payment system is an in-network permissioned blockchain that does not fulfill the ‘Satoshi vision’ of an open, un-censorable, public blockchain free from government control,” Eliscu pointed out, “the launch of Libra may nonetheless be looked upon as an ‘iPhone moment’ similar to Steve Jobs showing us in early 2007 a prototype of the smartphone as we know it today — an event which transformed the technology industry.”

Secure Wallet

The Calibra wallet uses strong protections to keep a user’s money and information safe, according to Facebook.

“We’ll be using all the same verification and anti-fraud processes that banks and credit cards use, and we’ll have automated systems that will proactively monitor activity to detect and prevent fraudulent behavior,” it said. “We’ll also offer dedicated live support to help if you lose your phone or your password, and if someone fraudulently gains access to your account and you lose some Libra as a result, we’ll offer you a refund.”

However, unlike the digital wallets of companies like Apple and Google, which contain specialized hardware to secure the wallet, Facebook’s wallet is software-based.

“Hardware wallets are the only secure digital wallets,” Reel Holdings’ Carr said. “Software wallets are just a waiting game for the inevitable compromise.”

Regulatory Challenges

Libra can give the cryptocurrency sector a boost by giving it something other digital money schemes can’t: an exchange medium.

“While bitcoin remains an excellent store of value, bitcoin — as well as most other cryptocurrencies used on public blockchains — are not ideal to be used as a medium of exchange,” DMG’s Eliscu remarked.

The key attributes of a medium of exchange are that it is widely accepted and relatively stable in value, he noted.

“As Facebook has 2.4 billion monthly average users and Libra is reported to be tied to the U.S. dollar, it has the immediate opportunity to fulfill this use case,” Eliscu added.

There will be some regulatory challenges facing Libra, observed Aurelie L’Hostis, a senior analyst with Forrester Research, a market research company headquartered in Cambridge, Massachusetts.

“The Cambridge Analytica scandal has exposed the social network’s lapses of data privacy and security, and the news comes at a time when Facebook is under intense pressure from regulators, shareholders and users to address privacy shortcomings,” she told TechNewsWorld.

“Now that Facebook is reaching out to financial firms and payments service providers to join the Libra consortium to help them launch their cryptocurrency-based payments system,” L’Hostis said, “we can expect regulators and governments to raise questions regarding Facebook’s financial data collection and management process, and whether that system meets all legal and regulatory requirements.”

Source: https://www.technewsworld.com

About the author