Never spend more than this much of your income on a car

Never spend more than this much of your income on a car. Tesla CEO Elon Musk views the new Tesla Model Y at its unveiling in Hawthorne, California on March 14, 2019.Frederic J. Brown | AFP | Getty Images

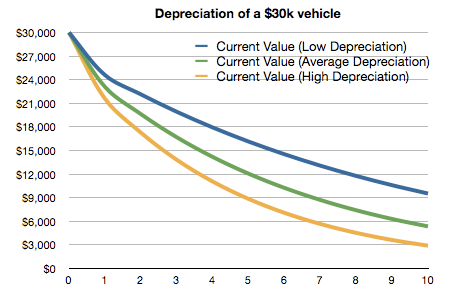

Americans have a complicated relationship with cars. Aside from buying a home, a car is probably the second-most expensive purchase you will ever make in your life.

After more than 10 years of writing about money on my personal finance website, Financial Samurai, I’ve found that being too fixated on the advertised price of a car is the biggest — and most expensive — mistake buyers make.

Too often, people will purchase a car without having a realistic understanding of how much more it will actually cost to own it. As a result, they end up spending too much and exceeding their budget.

Never spend more than this much of your income on a car

To save others from making this costly mistake, I came up with the 1/10th rule for buying a car. It’s simple: Spend no more than 10% of your gross annual income on the purchase price of a car.

Why? Because the upfront cost of a vehicle isn’t going to be the only thing you pay for, and cutting down your base price budget is the most effective way to save money.

If you make the median per capita income of about $42,000 a year, for example, you should limit your budget to $4,200. If you make the median household income of about $62,000 a year, don’t spend more than $6,200 on a car.

Why you may regret not following the 1/10th rule

According to a 2019 report from Experian, which tracks millions of auto loans each month, the average amount borrowed to buy a new vehicle hit a record $32,187 in the first quarter. The average used-vehicle loan also hit a record, $20,137. That’s far more than what most American households can afford.

Even so, Experian found that 20% of borrowers are taking out loans of $50,000 or more. That means, median income earners who buy median-priced cars are essentially spending almost 80% of their gross salary.

Worst of all, after they pay a 20% effective tax rate on their annual gross income, they’ll be spending almost 100% of their net income on the car!

Here are a few other major (though rarely considered) reasons why spending more than 10% of your annual income on a car is a horrible idea:

1. Maintenance (and other hidden) costs will eat up your savings.

The more you drive your car, the more expensive it will cost to maintain it. With thousands of parts to each vehicle, something will inevitably break, leak or need upgrading, especially after the warranty runs out.

And it’s not just maintenance costs: You’ll also have to pay for things like gas, interest on financing, insurance, parking and traffic tickets.

Furthermore, the thrill of owning a new or “new-ish” used car lasts for only several months, but the pain of paying the same car payment will last for years.